Introduction

Free Markets have some very simple fundamental elements. Although based on the actions of individuals, they combine to form extremely complex systems that we generally refer to as “markets.”

This article will provide a simple outline of those fundamental elements. I will refer to these elements in many of the letters that I plan to write in the future. I will follow up this letter with others that describe the elements in more detail.

I will post the content of these articles in a section to which readers will have ready access. I may update these descriptions as I get feedback from readers.

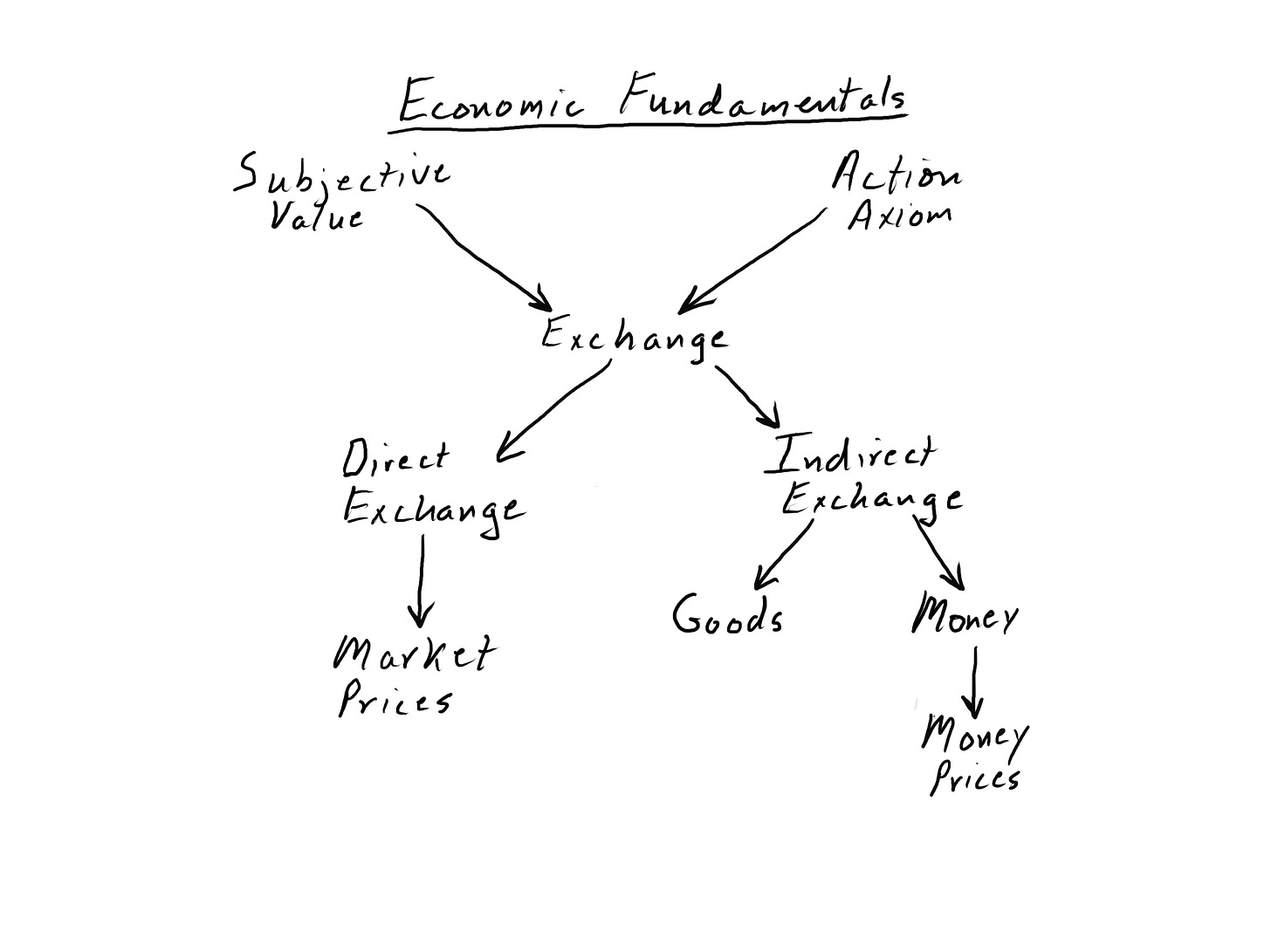

Below, I have provided a diagram of the relationships of these elements.

Subjective Value

You will read a lot about subjective value in future newsletters. Value lies at the core of all economic activity; however, many people misunderstand the source and measure of value. Numerous theories of value exist, but only subjective value survives logical tests.

In short, always and everywhere, only individuals determine value based on their personal preferences. I will explain the subject theory of value in more detail in future letters.

Action Axiom

The action axiom presents the a priori assumption that humans always act with purpose. This axiom has wide-ranging ramifications, as I will attempt to explain in a future newsletter.

Exchange

In short, when the action axiom meets subjective value, an exchange may occur. If each actor prefers what the other actor has more than what they have themselves, an exchange will occur. The exchange proves the relative valuations.

Direct Exchange

A direct exchange consists of an exchange in which the parties intend to consume what they receive.

Prices

A price consists simply of the ratio of the goods exchanged, usually from the perspective of one part or the other.

Market Prices

Market prices appear when the exchange ratios (or prices) of fungible goods amongst different traders tend to become the same.

Indirect Exchange

The concept of indirect exchange provides the basis for understanding the true complexity of market economies.

An indirect exchange exchange occurs when either party accepts a good in exchange with the intent of exchanging it later for another good.

Goods

Direct exchanges frequently occur with consumable goods. I shoemaker might accept a pound of coffee in exchange for a pair of his shoes with the intent of later exchanging the coffee for a chicken.

Money

I will devote a considerable amount of space to describing money and its role in a market economy. Above all, to fully understand money and its role, one must understand that people use money solely for indirect exchange. They have no intention of consuming it; they simply want it to exchange for other goods.

Money Prices

Money prices consist of the ratio of the amount of money exchanged for a specific quantity of other goods.

I want to make it clear from the outset that money prices do not represent measures of value. Only the individuals making trades will know the value.

Austrian Business Cycle Theory

I mention the Austrian Business Cycle Theory only to alert you to later discussions of how changes in the quantity of money affect money prices and, thereby, market decisions.

Conclusion

Extremely complex systems tend to emerge from the interaction of a few elements. Four forces drive the entire universe. The DNA of all life consists of permutations of only four parts. The vast range of colors on your screen results from mixing red, green, and blue.

I will devote the rest of my newsletters to explaining the interactions of a very few elements. Over the next few letters, I will explain these elements in more detail. I will post those explanations in a special section for future reference. (I will occassionally edit those explanations for the sake of clarification.)