Introduction

Ever since President Trump announced his tariff policy, I have wondered why he keeps insisting that other countries are "ripping us off." I knew that nothing harmed American consumers when they bought more from overseas than they did from the United States. I just couldn't understand why President Trump thought otherwise.

Recently, I saw a video in which Peter Navarro, President Trump's trade negotiator, explained his logic about trade deficits. I believe that I stumbled on the strange logic the makes President Trump believe that other countries take advantage of the U.S.

The Reasoning

The reasoning behind the "ripping us off" belief originates in a mathematical interpretation of the terribly flawed gross domestic product formula. I had overlooked this formula because of its many fundamental flaws, which I will discuss in other newsletters.

Gross Domestic Product Formula

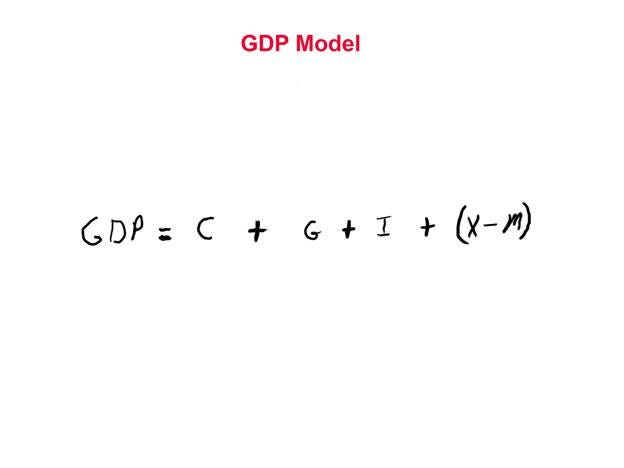

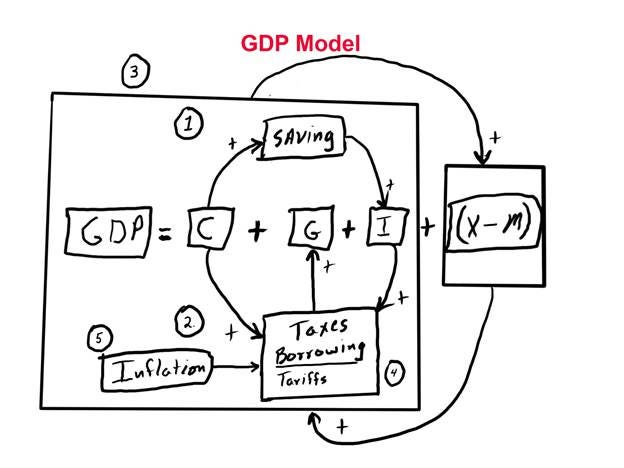

To understand the argument given by Peter Navarro, and I believe President Trump, you need to understand the "formula" used for calculating Gross Domestic Product (GDP). In the following image, I have given the formula for GDP. I will give a brief explanation below.

GDP-Gross Domestic Product

=

C-Consumption

G-Government Spending

I-Investment

Net Exports: (X-Exports minus M-Imports)

By using this formula, a person can supposedly calculate the total production of the national economy. People advocating this formula believe that increasing or decreasing any of the variables on the right-hand side of the equal sign will, in turn, cause a corresponding increase or decrease in GDP.

Many economists argue, for example, that increasing government spending will increase the production of the economy as a whole. My professors tried to teach that argument to me in college. (At a later date, I will devote an entire newsletter to discussing this argument.)

Interpreting Effects of "Deficits"

Since trade surpluses don't seem to present a problem, I will focus on the explanation given for the negative effects of trade deficits.

Using this formula, one can easily see that using basic math will cause you to believe that an increase in imports (M), which the formula deducts from exports, will have a negative effect on GDP. Imports rise; GDP declines.

This formula contains what I refer to as errors of aggregation. For example, summing the purchases of iPhones, chickens, and tractors, will not give you a meaningful measure of consumption. There are, however, other reasons to not treat these components as a mathematical formula.

Flaws in Reasoning

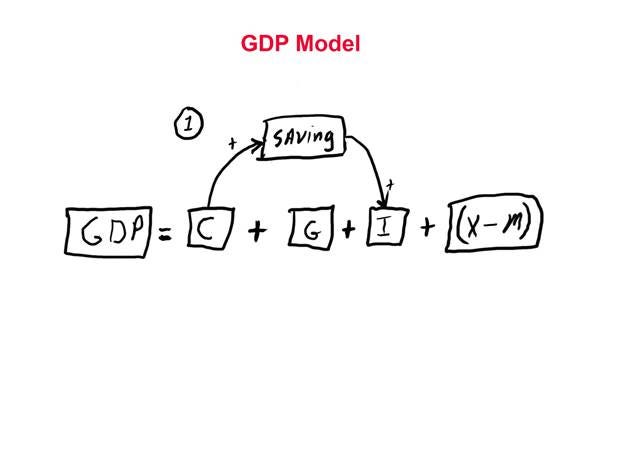

The variables in this formula actually consist of elements in a system. To make this point I have drawn boxes around each of the elements in order to construct a sort of causal loop diagram. (I hope that my systems-thinking friends will forgive me for this causal loop hybrid.)

Interrelationships

In an economic system, in order to increase investments, consumers must first reduce consumption, which by default creates savings. People can then use those savings to acquire investments.

You can begin to see the flaws in this linear formula. Raising or lowering the quantity in one element of the system will affect the quantities in other parts of the system. It will not raise or lower the whole.

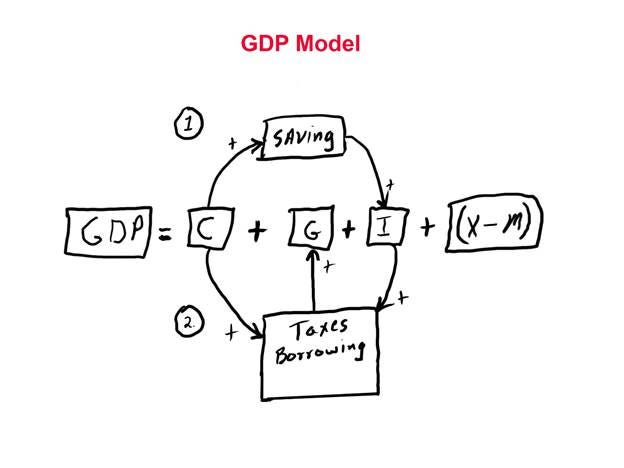

Financing Government "Spending"

Since the government produces nothing, it must have a source for the "spending" that it allegedly contributes to GDP. The basic sources of revenue for government "spending" consist of taxes or borrowing, both of which reduce consumption or investment.

The government contributes nothing to the economy; it simply redistributes resources that people would use for other purposes.

I have not yet addressed international trade. I will do that next.

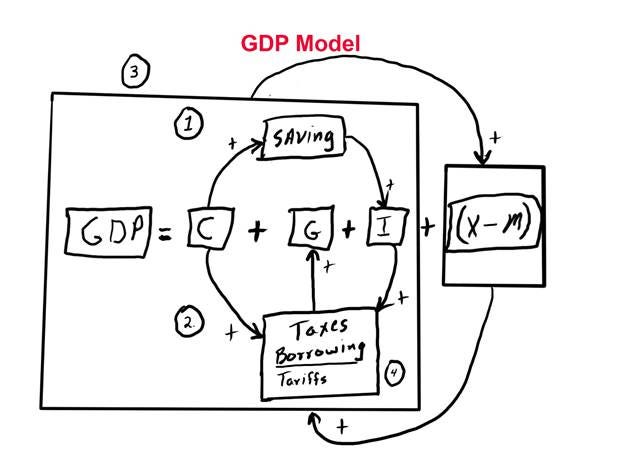

Treating National Economies as Units

Macroeconomists commit another error when they treat the elements within national economies as collectives. Economies consist of networks of individuals, not collectives.

However, to represent that "collectives" mode of thinking I have drawn large boxes around the national "collectives."

The United States does not conduct business as an entity with other countries as separate entities. If you examine real international trade, it occurs between individual entities that just happen to reside in different countries. The language used to describe "foreign trade" does not acknowledge that fact.

Since I am attempting to expose the flaws in the belief that other countries are "ripping us off," I will stick with this model.

The arrows flowing to and from the U.S. (the big box) depict the flow of dollars to and from entities in foreign countries. The outflows occur mostly in the form of increased consumption and reduced investment. The inflows occur to a large degree in the form of buying government securities, and some goes to investment.

Tariffs - Another Tax

Some people seem to believe that other countries pay tariffs. In reality, tariffs amount to another tax. In the long run, people pay taxes businesses and nations do not.

The burdens of tariffs, therefore, like taxes, reduce the amount of either consumption or investment. They finance the redistribution mentioned above.

Inflation Ripoff

You cannot complete an economic analysis without considering the effect of the expansion of the money supply, i.e., monetary inflation.

Banks create many of the dollars that are "spent" by the government. The government collects part of that "money" from taxes, the rest it borrows – by selling debt securities. When a bank buys a debt security from the federal government, it creates new dollars out of nothing. No one earned those dollars by producing a good or service. The addition of those dollars to the system starts the process that gradually reduces the perceived value of dollars in the system, eventually leading to what we call "price inflation."

As the increased dollar supply works its way through the economy, it has a negative effect on all consumers and producers. Businesses located overseas suffer in the same manner as domestic producers. The dollars they receive have less purchasing power than when they set the original asking prices.

I must raise the question at this point of whose ripping off whom?

Conclusion

Government officials make a horrible mistake in describing a market system as a mathematical formula. They ignore the individual nature of market transactions. They aggregate non-fungible goods. They do not recognize the information feedbacks that exist in all complex systems. They do not always recognize the distorting effect of monetary expansion. They do not acknowledge that tariffs amount to another form of taxation, and like all taxing and spending, they distort the proper functioning of the market.

Footnote:

I have used the term stupid on purpose. Stupid people take actions that harm themselves as well as other.

A stupid person is one who causes losses to another person or a group of people while they gain nothing or may even suffer losses. Definition