Introduction to Austrian Business Cycle Theory

What does all that funny money do to the economy?

Introduction

My previous discussion of money as a form of indirect exchange opens the door to discussions of The Austrian Business Cycle Theory.

Many people seem to misinterpret The Austrian Business Cycle Theory in spite of its importance. I believe that many of the misunderstandings come from its interpretation as a macroeconomic theory. Macroeconomics, in general, violates the principles of subjective value and individualism, which form the foundation for the Austrian method.

An accurate description of The Austrian Business Cycle Theory describes a level of complexity that challenges verbal description. I plan to develop numerous newsletters to explore this theory, but I want to introduce the theory with this brief outline.

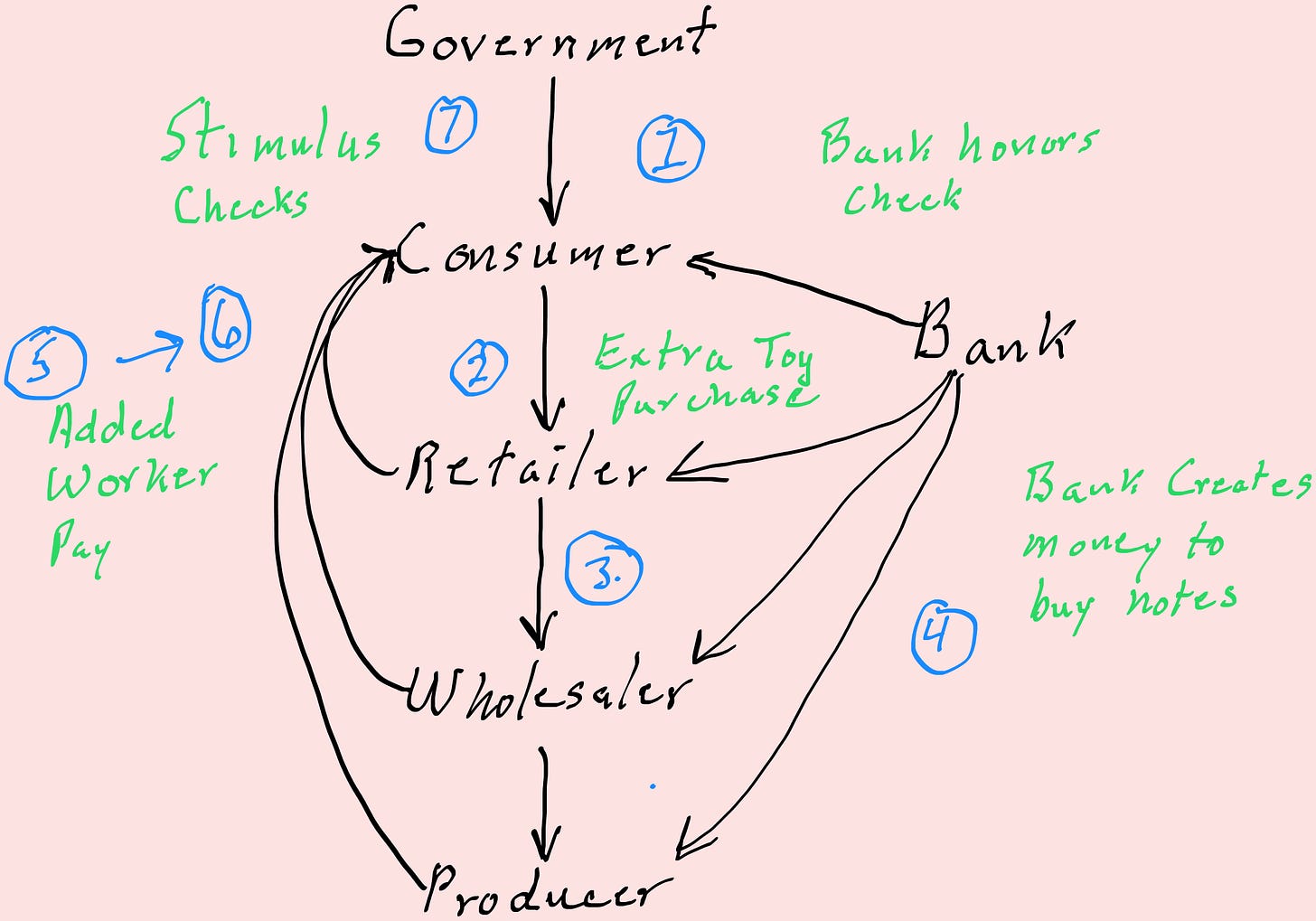

I have created this preliminary graphic to show the relationships involved in this theory.

Remember, I intend this as only an outline. A complete discussion of the theory will take a series of newsletters. I have outlined the two primary phases of the business cycle. In addition, I have developed only a single scenario for demonstration. In reality, these phases play out in a network of hundreds or thousands of scenarios.

The Boom

1. Stimulus Checks to Consumers

In this scenario, the process begins with the government providing “stimulus” payments to “needy” consumers. Those consumers “deposit” the checks in their banks. Those banks create new money (from nothing) in the form of deposit liabilities.

2. Consumers Buy Extra Toys

The consumers have a little more money than they would have had, so they purchase toys, which they would not have otherwise bought.

3. Retailers, Wholesalers, and Producers Raise Prices and Order More

The retailers, wholesalers, and producers all raise prices in order to (yes, increase profit) and to order more products and materials in anticipation of continuing increased sales.

(Notice: producers in the chain of production increase prices in response to consumer demand, not rising input costs.)

4. Retailers, Wholesalers, and Producers “Borrow” to Increase Production

The members of the chain of production require more money to pay for the additional resources they require. They offer their respective banks notes for future payment in exchange for current claims (i.e., money). The banks see the increased sales and judge the “loan” applicants as creditworthy. The banks create new money to buy the notes.

5. Retailers, Wholesalers, and Producers Pay More to Workers

The producers increase the hours of current workers and hire new workers to meet the new production demands.

6. Workers/Consumers Add to Demand

Note that workers also become consumers. When these workers/consumers have more money, they add to the increased purchases of toys initiated by the stimulus payments.

7. Cycle Repeats

Created by the several increases in the quantity of money, the cycle of stimulus, consumption, production, consumption repeats.

Monetary expansion has caused a boom.

Inflation

In this example, I have focused on the toy business. Many more industries go through the same cycles, all the result of the false signals given by artificially manipulated price signals.

When the price increases have become sufficiently widespread, we call this price “inflation.” Too late, the people who started this whole thing realize a problem exists.

After the boom comes the bust…

The Bust

8. Stimulus Ends

In this scenario, the government sees the artificially created boom and thinks the stimulus has worked. They stop the stimulus payments.

The original toy buyers have to cut back on these extra purchases.

9. Retailers, Wholesalers, and Producers Cut Back

The producers see the sales declines and begin to reduce production.

10. Worker Pay Declines

Because of the production cutbacks, workers/consumers have less money to spend, and they reduce their toy purchases. Now, the cycle reverses. The toy business goes into decline.

11. Banks May Call “Loans”

Because of declining revenues, many of the toy producers have difficulty making loan payments. Banks stop buying notes from toy producers, and they must foreclose on those who cannot make payments.

12. Recession

As with the expansionary boom, the decline in business spreads to other industries.

Again too late, those who caused the problem realize the generalized decline meets their definition of a recession. So, what do they do?

More stimulus.

Summary

1. False price signals caused by artificial monetary expansion lead producers to misinterpret consumer demand.

2. Producers expand production, causing a boom.

3. “Successful” stimulus leads to termination of the program.

4. The process reverses, causing inflation and a bust.

I have created a model based on a single industry (and even that model does not have sufficient complexity.) With this example, I have demonstrated the disruption caused by an expansion in the money supply.

This disruption has a devastating effect when applied on a wider scale.

The whole story caused by monetary expansion, from boom to bust, encapsulates The Austrian Business Cycle Theory.