Introduction

All taxes represent the first step in the process we politely refer to as “tax” and “spend.” We should refer to these two steps more accurately as theft and redistribution. All taxes distort the resource allocation processes of free markets. The citizens of most countries accept the distortions caused by taxation as a cost of citizenship.

The amount of damage from taxation varies with the type of tax. Income taxes have a particularly damaging effect because they punish success. Progressive income tax rates increase this distortion because they penalize the most successful individuals who also contribute the most to the economy.

Sales taxes tend to do the least amount of damage because buyers have a modicum of choice about when and how much they pay.

Tariffs act as the most damaging taxes of all. For the uninformed, tariffs seem like a different form of sales tax because the consumer decides when to pay them, but the similarity ends there. They have a number of other problems:

ü They punish buyers who prefer selective goods.

ü They add to the holding expenses of producers.

ü They cause an involuntary distortion of the resource allocation of producers outside the jurisdiction to the taxing government.

ü High tariff rates can kill businesses.

I will devote more space to these problems at a later date. In this newsletter, I will outline the impact of tariffs on the profits of small businesses. I will describe three scenarios that apply mostly to small businesses.

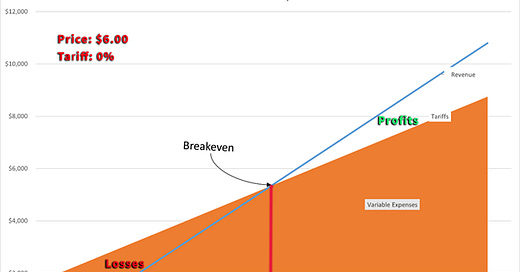

Zero Tariffs

To set the context for this discussion, let’s examine a breakeven analysis of a small business with no tariffs.

The number of units sold appears on the bottom (horizontal axis.) The left axis shows the total dollars for the various variables (revenue or expenses.) I have (arbitrarily) set the price of this company’s product at $6.00.

The blue area at the bottom represents fixed expenses, such as rent. Fixed expenses remain the same regardless of the number of units sold. The orange area reflects the variable expenses, which increase with each additional unit sold. The primary variable expenses consist of wages and the cost of goods sold. (Tariffs have a label on this chart eventhough I have set the rate at 0%.)

The diagonal blue line, which starts at zero and increases as the number of units sold increases, represents the total revenue.

Based on the underlying figures, this business achieves breakeven at roughly 900 units. Sales of fewer than 900 units will result in a loss of money for the business. Sales of more than 900 units will result in a profit for the business.

I will use the same expense parameters for the next two scenarios.

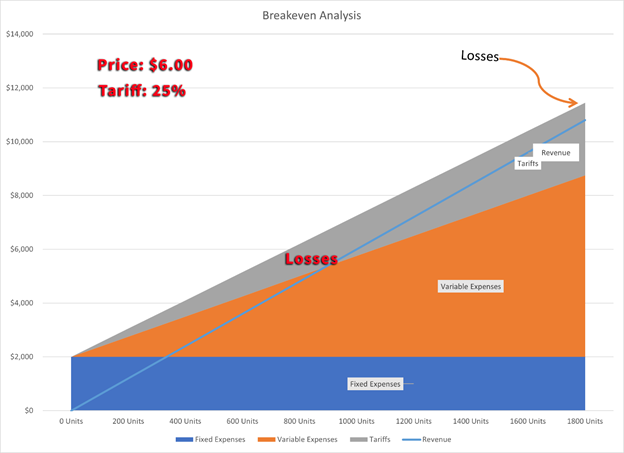

25% Tariff - $6.00 Price

In this scenario, I have only added a 25% tariff. Seldom have tariffs reached as high as 25%, but that represents a figure well within the range discussed by the current administration.

With this level of tariffs, making a profit becomes impossible. To anyone suggesting, “Just sell more,” I respond that the business would not have settled on the $6.00 price if they could have either sold more at that price or raised the price.

These tariffs will force this business to close.

25% Tariff - $7.50 Price

In order to complete this “thought experiment” in the following chart, I have reflected a 25% increase in price to offset the 25% tariff directly. Everything else stays the same.

You will observe immediately that the breakeven increases from roughly 900 units to about 1100 units. To make money, the business must raise prices more than that. Highly unlikely.

With the increased price, the business will probably lose marginal customers who do not want to pay more than $6.00. So, what does the business owner do?

Cutting fixed expenses is practically impossible to maintain the same productive capacity.

The only practical solution consists of cutting variable expenses. If the business owner negotiated the best deal for his business, reducing the cost of goods does not seem likely. Cutting workers seems like the only alternative.

Wait. Isn’t the purpose of tariffs to increase U.S. employment?

The imposition of tariffs has done nothing to help this business. Why punish American businesses to help American businesses?

Conclusion

A large portion of U.S. businesses have very limited capacity to withstand sizable (e.g., 25%) increases in their costs. They cannot simply hang in there. They depend on short-term sales based on long-term order-shipment times.

These business owners either don’t understand GDP or don’t care about it. Politicians and day traders in Washington, D.C. make up policies that will literally put many of these businesses out of business. And these policies could trigger a tsunami— a surge below the surface —that could lead to an economic catastrophe.

Do what you can to stop this nonsense.