When Ben Bernanke ballooned the level of total reserves in the banking system, he did two things. First, he made the amount of excess reserves totally irrelevant. Second, he revealed that the dollars created by the Federal Reserve, contrary to popular belief, have never acted as money.

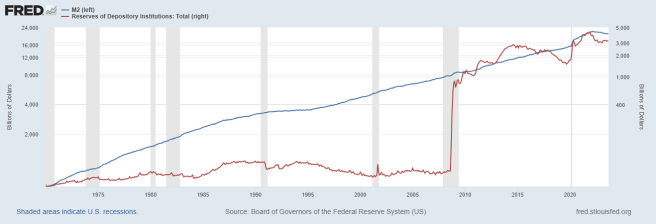

The following chart provides a visual depiction of the topics that I will explain below. The blue line shows the money supply (M2) from 1970 to 2023 with its scale on the left. The red line shows reserves held at Federal Reserve Banks during that same period with the scale on the right.

(Note: the y-axes on this chart are both logarithmic scales. They depict more accurately the rate of change in both bank reserves and the money supply.)

Quantitative Easing

According to conventional thinking, the Fed “pumps” “money” into the economy when it increases bank reserves. When Ben Bernanke made a massive increase in Reserves with “quantitative easing,” analysts expected the quantity of money to increase dramatically, but that did not happen in the magnitude expected.

(During 2008, bank reserves increased by 43.3% while the money supply increased by 1%.)

Covid Spending

Later in 2020, bank reserves increased because of the dramatic increase in federal spending justified by the Covid 19 outbreak. The quantity of money at that time increased dramatically.

That expansion of the quantity of money caused the worst price inflation this country has seen for decades.

(During 2020, bank reserves increased by 7.5% while the money supply increased by 2.3%, and it continued to increase.)

Truth Revealed

What people referred to as “quantitative easing” had little to do with increasing the quantity of money in the economic system. By buying assets from banks, Bernanke improved the capital required for banks. The quality of assets owned by banks affects the capital requirements mandated by regulators (fooling customers into believing banks are sound).

The massive increase in total bank reserves made excess reserves (the amount of total reserves in excess of required reserves) irrelevant. Increasing and reducing excess reserves had been the tool by which The Fed influenced the quantity of money that banks could create. With the large increase in total (and excess) reserves, The Fed lost its leverage. Subsequently, The Fed has acknowledged this fact by reducing the reserve requirement to zero.

This “creative” banking revealed a fact that many, even today, do not acknowledge. Dollars created by The Fed do not act as money. Consider that under any circumstance, a commodity or a claim on a commodity cannot act as money and a reserve simultaneously. In addition, citizens cannot have accounts at The Fed, precluding reserve dollars from use as money. The chart above shows how, until QE, the quantity of money (M2) grew steadily while bank reserves remained mostly level.

Conclusion

The Federal Reserve remains the largest player in the open market system. This gives them a level of influence beyond that of other players, but that influence has become more indirect and greatly muted. The “Fed Watchers” need to direct their attention to the money-creating influence of banks. Quit talking about The Fed “raising rates” (which they cannot do.)

Recently, a disturbing downward trend in the money supply has developed. Keep your eye on it. What effect will it have on prices? In general, price declines resulting from increased production give a positive signal; price declines resulting from reduced money supply give a negative signal.

Which will it be?

This article piques my interest in discovering why we still have or ever had to create the Federal Reserve.